Investing can be a powerful way to build wealth over time, but it’s important to understand the tax implications of your investment decisions. If you’re not careful, you could end up paying more taxes to the Canada Revenue Agency (CRA) than necessary. Fortunately, there are several steps you can take to minimize your tax burden and maximize your investment income. In this blog post, we’ll explore four steps you can take to get investment income without paying the CRA more taxes.

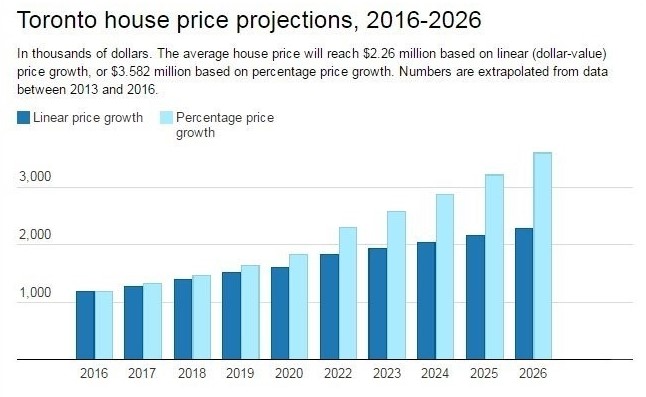

Continue readingToronto home prices are down 14% from a year ago, sales down 44%

The decline in the Toronto real estate market has taken a toll on the local economy, as job losses and rising costs have made it difficult for potential buyers to secure a mortgage. Many buyers have faced a steep decline in their savings due to the economic downturn, making it difficult to purchase a home. As a result, the demand for housing in the GTA has decreased, leading to a significant drop in sales.

Continue readingToronto Vacant Home Tax Deadline Extended

Toronto, one of the largest cities in Canada, is known for its diverse and thriving communities. In an effort to encourage property owners to put their empty residential properties back into use, the City of Toronto has implemented the Vacant Home Tax. This tax applies to all homes in Toronto that are unoccupied for more than six months in a year and is calculated as 1% of the property’s assessed value. To avoid paying the Vacant Home Tax, property owners must declare their property’s occupancy status each year by completing a declaration form and submitting it to the City of Toronto.

Continue readingNew trust reporting requirements

The Canadian government has recently announced new trust reporting requirements that will take effect for trusts with taxation years ending on or after December 31, 2023. These changes represent a significant shift in the reporting obligations for most trusts and could potentially affect a wide range of taxpayers and their advisors. In this blog post, we will provide a comprehensive overview of the new requirements and what you need to know to get ready for them.

Continue readingBoost for Canadian Small Businesses

Small businesses play a vital role in Canada’s economy and the government has been taking steps to support and grow this important sector. In December 2022, a new bill, Bill C-32, received Royal Assent that brings significant changes to the small business deduction program.

Continue readingNew Era of Tax Transparency

Understanding the Proposed Mandatory Disclosure Rules for Certain Tax Transactions. As countries across the world seek to ensure tax fairness and increase revenue, governments are turning their attention to tax transactions. The Canadian government is proposing new mandatory disclosure rules for certain tax transactions, in an effort to promote greater transparency and ensure that everyone pays their fair share.

Continue readingNew anti-flipping rules for residential real estate

The Canadian government has implemented new anti-flipping rules for residential real estate transactions, in a bid to address the growing concerns over affordability in the country’s housing market. These rules aim to curb speculative activities in the real estate market, as well as prevent the flipping of properties for quick profits.

Continue readingProposed amendments to the GAAR

The General Anti-Avoidance Rule (GAAR) is a critical component of Canada’s tax system, aimed at preventing taxpayers from engaging in tax avoidance activities that would undermine the integrity of the system. The Federal Government has recognized the need to modernize the GAAR, and as a result, has released a Consultation Paper proposing several changes to the rules.

Continue readingIs your income 55K or less Consider using a TFSA over RRSP Advisor

For many Canadians, the decision between a Tax-Free Savings Account (TFSA) and a Registered Retirement Savings Plan (RRSP) can be a difficult one. Both accounts offer distinct benefits and drawbacks, and choosing the right option for your personal circumstances can be a challenge. Those earning an annual income of $55,000 or less should strongly consider the TFSA over the RRSP.

Continue reading